By accessing and utilizing this site, you acknowledge that you simply possess the necessary proficiency in English to grasp the information provided. If you’ve any doubts about your language proficiency, we recommend looking for assistance from an expert interpreter or translator. Acquire, convert and send funds worldwide tapping into new revenue streams by setting and controlling FX mark ups and payment charges. Growing a new platform takes plenty of time and effort, which takes resources away from different core areas of your small business you want to give attention to. Utilizing our platform personalised together with your model will increase public awareness when your prospects see your name.

Ways Foreign Exchange Crm Enhances And Scales Brokerage Efficiency

- There is a register of forex firms that ensures the reliability and transparency of operations carried out under the supervision of the regulator, the Nationwide Bank of the Republic of Belarus.

- Finxsol is an Impartial Fintech consulting agency specializing in helping businesses launch and connect with tailor-made choices from Completely Different Providers.

- A good white label CRM comes with lots of of customizable parameters to be able to tailor it to the unique necessities of your brokerage.

World renowned Metaquotes buying and selling platform integrated with Broctagon’s full resolution suite. Learn how A-Book and B-Book fashions work for prop firms and why a hybrid approach ensures sustainability. Stand out from the competitors by offering a prepared made platform in your brand. Strengthen your trust and credibility along with your prospects providing them with a dependable and secure way to do business globally.

Forex white label broker options are in style among entrepreneurs and established corporations seeking to diversify their revenue streams by offering buying and selling providers. The creation of white label options has completely revolutionized the monetary technology (fintech) world. With WL resolution packages, brokerage businesses of all sizes (particularly small brokers) can now easily launch their companies at a greater cost and in a shorter period. Its wide selection of options is encouraging a new generation of buying and selling platforms which may be standing out within the fintech area. Besides white labelling expertise, liquidity is another key element in finishing your brokerage setup.

Reap the advantages nearly immediately once we release cutting-edge features and updates — our resolution comes with a steady release cycle and undergoes constant testing that won’t have an result on your every day operations. Implementation of robust cybersecurity measures to guard shopper info and monetary knowledge. Issues embrace double tax treaties, company tax rates, and the implications of business offshoring and funding offshoring methods. It is important to know that these safety measures usually are not only for present, they’re fully useful as they had been set up to ensure the security of the software. Therefore, consumers must be rest assured that WL software program could be very protected to make use of. This mix enables you to seize totally different segments of the dealer market, from those looking for classic analysis applications to those wanting instant funding or publicity to particular asset lessons.

Navigating the advanced regulatory landscape is important when you begin a foreign exchange dealer business. Understanding onshore vs offshore licensing, minimum capital requirements, and compliance obligations ensures your foreign exchange broker setup operates legally whereas constructing belief with clients. You step right into a system trusted by over one hundred corporations worldwide, full with pre-integrated platforms like Match-Trader, cTrader, DXtrade, and Rithmic.

Benefits Of Turning Into A White Label Foreign Exchange Broker

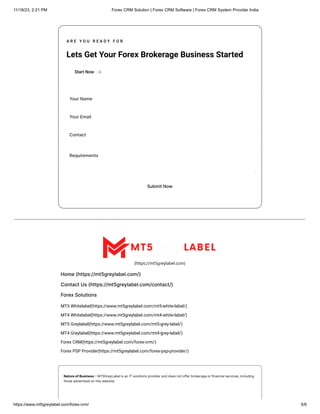

A white label forex program permits entrepreneurs and corporations to begin out their very own foreign exchange brokerage underneath their very own brand name while using the know-how, liquidity, and regulatory framework of an established supplier. This turnkey resolution provides everything wanted to start out a forex White Label Forex Solution brokerage without the large upfront funding in expertise development. Launch your own branded foreign exchange brokerage in 5-7 days with our full white label trading platform packages. Finxsol’s streamlined 14-day course of to launch your brokerage with our comprehensive white label resolution. Our confirmed methodology ensures a whole setup with full regulatory compliance and branding capabilities.

Fund Managers

This custom plan offers you more flexibility to differentiate your brand available in the market, while still relying on PropAccount’s confirmed infrastructure, automation, and risk methods. The result is a scalable risk management system that protects your capital and status from the very first day. The white-label supplier provides the MT4 and MT5 server phase, software program, mechanism for conducting transactions on the exterior market, reliable backup system, constructing of a worldwide entry server network, etc.

By leveraging ready-made solutions, corporations can shortly create a model presence, cut back operational prices, and ship exceptional trading experiences to their purchasers. White label liquidity aggregation is a classy know-how answer that allows brokers to entry multiple liquidity suppliers via a single connection. This broker liquidity aggregation system combines streams from numerous sources to supply the finest possible execution for clients while minimizing danger publicity. These platforms sometimes support a number of asset courses corresponding to forex, shares, commodities, and cryptocurrencies.

Want to get to market quickly or leverage an present answer rather than construct your own? Get to market fast with Currencycloud’s white label cross-border platform. Data introduced is provided ‘as-is’ and solely for informational functions, not for trading functions or recommendation, and is delayed. No representations are made by Barchart as to its informational accuracy or completeness. Prices differ but sometimes range from $5,000 to $30,000 within the first 12 months, together with setup and operational bills. Total, small to mid-sized brokerages can count on to invest between $5,000 and $30,000 within the first year, depending on scale and options.

If you operate in regulated markets, you might incur extra bills for authorized companies, licensing applications, and regulatory audits. The execution engine ensures totally computerized and dependable execution with real-time alerts for monitoring. Our White Label Again Workplace resolution will streamline your administration and assist you to develop your small business with superior Foreign Exchange CRM capabilities. Secure, Role-Based User Control to manage permissions across your organization with customized access ranges.